28.02.2023 16:19

Common Regulations for the Use of Natural Gas Transmission System (ENG) from 01.04.2023

Download

569165 KBIn the meaning of the Natural Gas Act network service is a service of providing natural gas transmission or distribution through the network of gas pipelines.

Elering provides natural gas transmission service, transporting natural gas through the transmission pipelines from the border of Estonia to the agreed connection points.

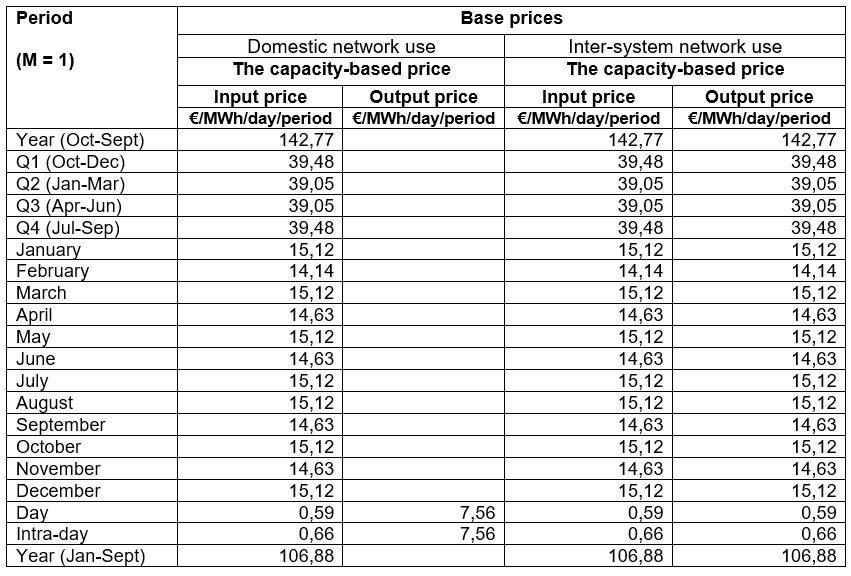

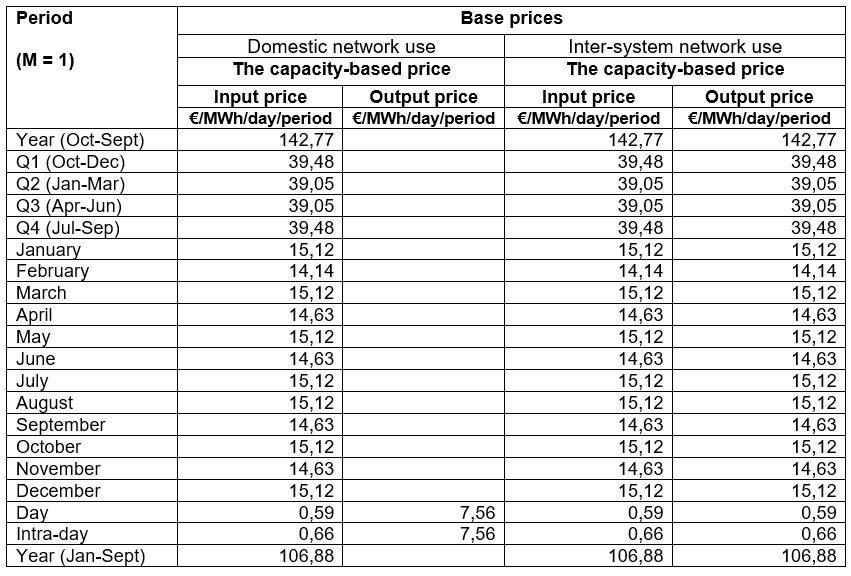

Transmission service tariffs from 01.10.2020-03.12.2023

Transmission service tariffs 01.01.2020 - 30.09.2020

Transmission service tariff 01.01.2019 - 31.12.2019

Starting from 01.01.2020, the "Standard Terms and Conditions for the National Gas Transmission Service for Elering AS", approved by the Competition Authority's decision No 7-10/2019-006 of 06.09.2019 and the "Common Regulations for the Use of Natural Gas Transmission System", approved by the Competition Authority's decision No 7-10/2019-007 of 30.09.2019, entered into force.

With decision 28.02.2023 nr 7 10/2023-002 Competition Authority approved amendments in Elering AS and AS "Conexus Baltic Grid" Common Regulations for the use of Natural Gas Transmission System, which are applicable from 01.04.2023. Amendments are needed to formally implement European Commission and Council Regulation (EU) 2022/2576 of 19 December 2022 Article 14.

Since 1 January 2008, natural gas amongst other fuels in Estonia has been taxed with an excise according to the Alcohol, Tobacco, Fuel and Electricity Excise Duty Act. According to the law, the obligation of payment and declaration of excise lies with the network service provider.

Natural gas is subject to excise duty when used as a heating fuel, when heat is produced from natural gas, or when natural gas is transmitted from the network to a consumer who is not a network operator or a combined heat and power producer using natural gas.

For more detailed information on excise duty, including current excise rates, please refer to the Estonian Tax and Customs Board website.

The regulation of the Council of Europe obliges member states whose territories do not have the necessary gas storage facilities to store at least 15 percent of their annual gas consumption in terminals located in other member states.

The purpose of Estonia’s strategic gas reserve is to ensure the primary preservation of the gas supply in case of large-scale supply interruptions.

Gas reserves are handled by the Estonian Stockpiling Agency.

The strategic gas stockpiling fees are established by the Minister of Economic Affairs and Communications at the proposal of the Council of the Estonian Stockpiling Agency.

Transmission service tariffs from 01.10.2020-03.12.2023

Transmission service tariffs 01.01.2020 - 30.09.2020

Transmission service tariff 01.01.2019 - 31.12.2019

Starting from 01.01.2020, the "Standard Terms and Conditions for the National Gas Transmission Service for Elering AS", approved by the Competition Authority's decision No 7-10/2019-006 of 06.09.2019 and the "Common Regulations for the Use of Natural Gas Transmission System", approved by the Competition Authority's decision No 7-10/2019-007 of 30.09.2019, entered into force.

With decision 28.02.2023 nr 7 10/2023-002 Competition Authority approved amendments in Elering AS and AS "Conexus Baltic Grid" Common Regulations for the use of Natural Gas Transmission System, which are applicable from 01.04.2023. Amendments are needed to formally implement European Commission and Council Regulation (EU) 2022/2576 of 19 December 2022 Article 14.

Since 1 January 2008, natural gas amongst other fuels in Estonia has been taxed with an excise according to the Alcohol, Tobacco, Fuel and Electricity Excise Duty Act. According to the law, the obligation of payment and declaration of excise lies with the network service provider.

Natural gas is subject to excise duty when used as a heating fuel, when heat is produced from natural gas, or when natural gas is transmitted from the network to a consumer who is not a network operator or a combined heat and power producer using natural gas.

For more detailed information on excise duty, including current excise rates, please refer to the Estonian Tax and Customs Board website.

The regulation of the Council of Europe obliges member states whose territories do not have the necessary gas storage facilities to store at least 15 percent of their annual gas consumption in terminals located in other member states.

The purpose of Estonia’s strategic gas reserve is to ensure the primary preservation of the gas supply in case of large-scale supply interruptions.

Gas reserves are handled by the Estonian Stockpiling Agency.

The strategic gas stockpiling fees are established by the Minister of Economic Affairs and Communications at the proposal of the Council of the Estonian Stockpiling Agency.

What are you looking for?